After my talk at the World Skeptics Congress, I had an interesting conversation with the owner of a small, technology-driven company. The whole conversation lasted no longer than a cup of coffee. The main question was how a small to mid-size company can leverage the principles for dealing with uncertainty that I had outlined at the end of my conference talk. Here are the results of our talk (plus some explanations) in a few quick points:

- Work with the knowledge that exists in your company. If you needed outside experts to tell you how your own market works, you would have probably gone out of business already. Outside help may, however, be useful (and sometimes necessary) to moderate the planning and decision process, to calculate financial impacts and to ask critical questions. The more technical and market expertise a business leader displays, especially if he or she is also the owner or founder of the company, the more hesitant many employees may be to bring up risks they see or feel looming on the horizon.

- Make it clear what the purpose of the analysis is. Are there strategic decisions to make – if so, what are the options? If you want to test the viability of an ongoing strategy, what are the areas in which you could make adjustments? In addition, define a reasonable time range you want to plan. If you plan to build a production facility, that time range will be much longer than if you develop mobile phone software.

- Look at uncertainties inside-out, going from effects to possible causes. The number of things that can happen in the world around you is infinite. The number of significantly different impacts on your business is rather small. Start with the baseline plan for your business – you have one, explicitly or implicitly. Look systematically what could change, for example in a tree structure: Sales or cost could be impacted. On the sales side, demand or your ability to supply could change. A change in demand could come from the market size or your market share. Market size can change via volume or price level. Get rid of branches in the tree that are (even after critical questions) unrealistic, have negligible impact or would not be affected by the strategic options or adjustments you are evaluating. If you can’t prepare for it, there’s no point in planning it. Also, don’t continue into branches that have identical or very similar impact on your actual business.

- Identify key drivers of uncertainty and find possible values. Each branch of the tree gives you a driver of uncertainty. Compare their impact and get rid of the minor ones. You should end up with no more than ten key drivers (or ten for each market you are in, if there are several). Then assign two to five possible values each driver could have in the future. Think of normal as well al unusual developments, but try to avoid the generic base/best/worst assumptions.

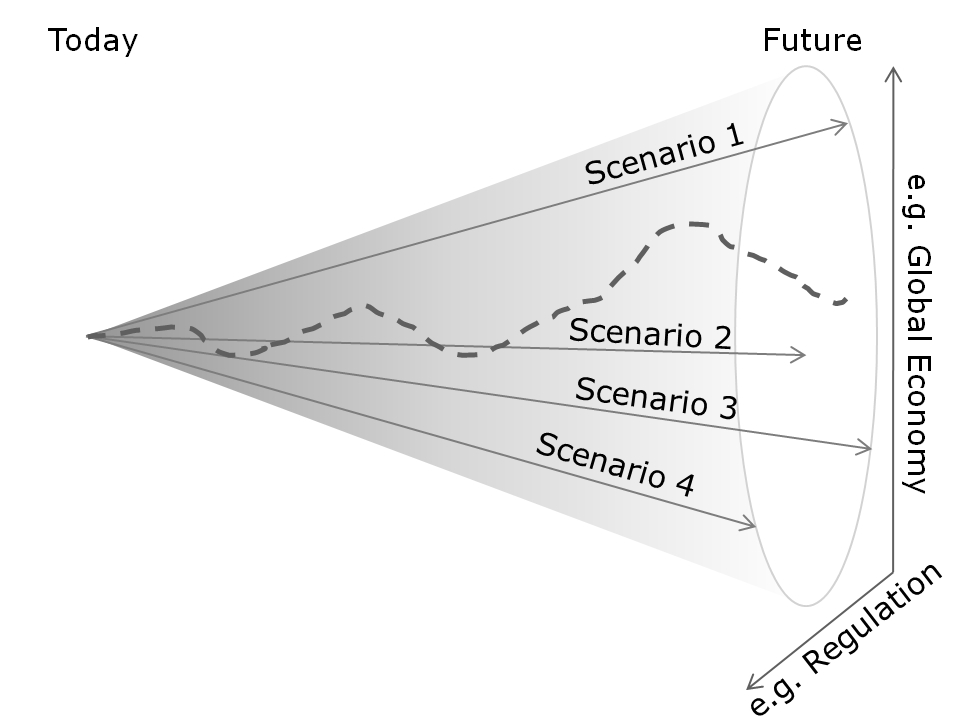

- Condense possible developments into scenarios. The different values of the drivers open up a cone (see graph below) of possible future developments. Scenarios are roads through that cone. The real future will not be identical to any one scenario, but should be somewhere around or between them. A scenario contains one possible value for each driver. Start out by looking for reasonable combinations of values, then build scenarios around them. There should be at least three scenarios, and more than five or six are rarely necessary. At least one scenario should cover the center of the cone of possible developments mentioned above, but others should lead to the more extreme corners, as well.

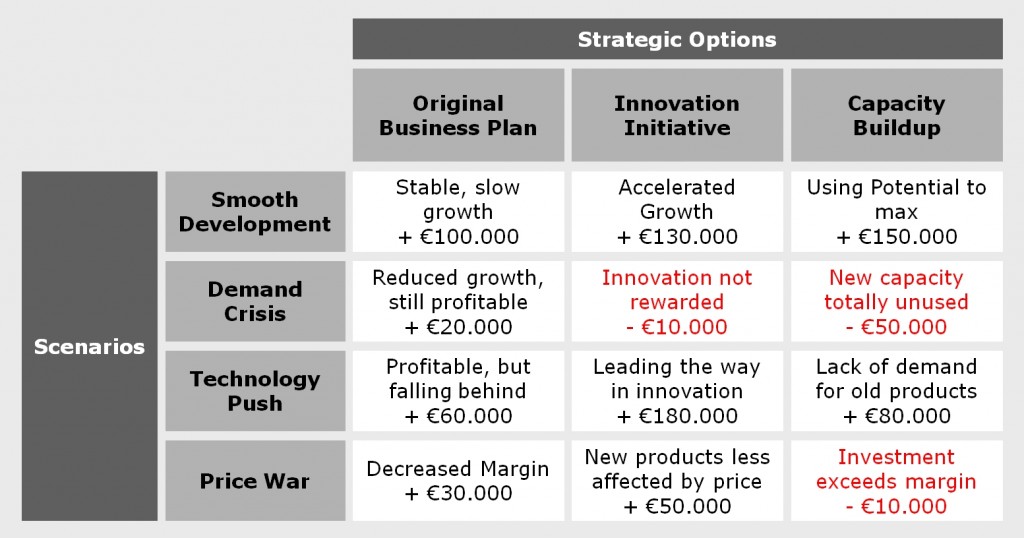

Isolate single factors that don’t fit into the scenario logic, either because they are independent from anything else (oil prices or tax rates sometimes fit in that category) or because there is a feedback (for example, in a local market, competitors may react to the strategy you choose). There should be no more than two or three such factors. Keep them separated and at the end of the whole process, check if varying them within reasonable limits changes the results of your analysis. - Derive the impact on your strategy and options. In a larger company, I would develop an interactive business plan simulation to do this, but in smaller companies, a grid of results with manual calculations or estimates should do. One axis of the grid are your strategic options or your current strategy and possible adjustments. The other axis are the scenarios. Write down (with some basic numbers!) where your company will be at the end of the planning period with each combination of strategies and scenarios. If a strategy looks catastrophic in one scenario or survivable but bad in several scenarios, you may want to stay away from it. If you decide on a strategy and find that it runs into trouble in one of the scenarios, derive which of the scenario’s values in the key drivers could function as an early warning indicator.

- Do it! Here’s your main advantage over some of the multi-billion-Euro companies out there: Once you have come to a conclusion, actually implement it. Write down which steps you have to take to make it happen and check them off. If you have come up with early warning indicators, hang them on your office wall, put them on your computer desktop or into your calendar at regular intervals and test them. The only bad thing you can do with this analysis is to let it rot in your drawer.

Dr. Holm Gero Hümmler

Uncertainty Managers Consulting GmbH