We apologize for the inconvenience. Unfortunately, the Federal Republic of Germany and its capital are unable to complete the country’s most prestigious infrastructure project anywhere near on time. Whoever was planning on doing business around Berlin Brandenburg Airport better has a Plan B somewhere in the drawer.

Unfortunately, as even international media is pointing out by now, such delays are not an unusual problem for large public or semi-public development projects in Germany. More often than not, they come with a hefty extra bill for the taxpayer: Hamburg’s new concert hall, the rebuilding of the Stuttgart central train station, the Cologne subway, even the new headquarters for Germany’s foreign intelligence service are due to open years behind schedule and with a total cost far beyond the original price tag.

Various commentators, including Oxford project planning professor Bent Flyvbjerg, see a method behind the madness: Faced with a public that is generally hostile towards new technology or infrastructure, German politicians tend to be overly optimistic on cost and timeline to get their investments through the political process. The resulting problems will usually be inherited by their successors, while after successful completion, much of the positive aspects of the project will be attributed to the long-retired initial promoter. Positive examples cited often come from the UK, like the 2012 olympics or the extension of Heathrow airport. However, it is quite obviously possible to complete major infrastructure investment according to plan in Germany , as well: The Frankfurt airport operator Fraport has a history of completing projects like the North-West runway or Terminal 2 on time and within a reasonable budget, at least once external political and administrative hurdles have been cleared. Planning is not perfect there, either, as it never will be: Terminal 2 was designed to handle airliners even larger than today’s A380, which are nowhere in sight, while passengers boarding the many much smaller planes there today mostly have to use rather unconvenient bus gates. However, the simple fact that the capacities promised were available at the time they were promised is a key factor for Frankfurt’s continued success.

So, are the delays at Flughafen Berlin Brandenburg a problem of strategic planning? They certainly weren’t caused by mistakes in strategic planning. If professor Flyvbjerg is right, they were caused by a combination of intentionally overambitious aims, supported by the politically elected board members, and unprofessional project management. To a certain extent, the delays of course represent a problem for strategic planning. However, no strategy could have prepared the company to survive maintaining a complete international airport that does not produce revenues for years without getting help from the (public) ownership.

The most interesting strategic planning questions come up outside the airport operator. About 80 tenants were waiting to start their business in the new terminal. Airport shuttles and logistics companies were preparing for the new airport.

For most companies planning to do business with, at or around the new Berlin airport, the fact that there are delays isn’t even the worst part. Many will be growing or migrating from existing businesses, and most will be renting rather than investing in actual real estate, so they should in principle be able to adjust to a change of schedule, given reasonable advance notice. Therefore, the postponement from October 2011 to June 2012, announced in June 2010, should not have been a disaster for most companies affected, as they were still far from operational readyness.

However, until May 8, 2012, the official opening ceremony of the airport was announced for May 24, the beginning of regular flight operations for June 3rd. Less than four weeks before facilities for 70000 passengers a day had to be running, the beginning of operations was postponed to August, then to March 2013, to October 2013, then “until further notice”. Even for tenants and contracting parties of the airport operator, who can at least hope for some degree of compensation, such a process must be a threat to a company’s very existence. At this point, employees have been hired and must be paid, merchandise or material have been ordered and can only be canceled at additional cost, interest on investment must be paid, and equipment starts losing value, even if it isn’t used.

So what can planning contribute to limit the damage from such a timeline change? Is it primarily a matter of operative project planning or does it involve strategic questions?

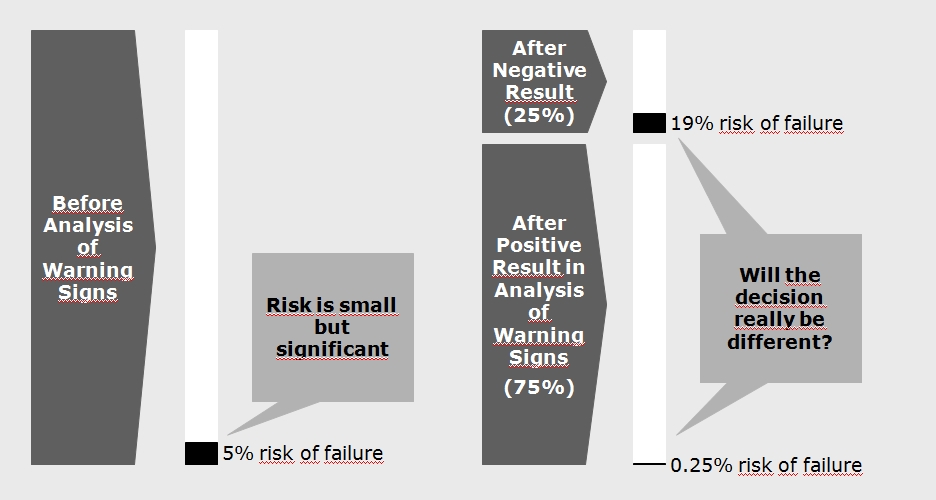

From the point of view of uncertainty, this is in fact a rather simple planning problem, as there is one dimension of uncertainty dominating the whole process, and with the official dates fixed, the only direction the timeline can change to is backwards. The planning process, therefore, becomes a combination of traditional project planning with uncertainty-based strategic elements. The following points have to be addressed:

- Basic Project Plan: Given the official external timeline, what should the own project plan look like? What are the internal deadlines? In the case of a tenant planning to run a retail business at the new terminal, when should the furniture be ordered, when the merchandise, when is the workforce hired and trained, when must the IT be ready?

- Resulting Business Plan: What does the financial side of the project plan look like? What investments have to be made, when do running expenses start? When can the first revenues be generated?

- Dependencies: At which points could external uncertainties, in this case the timeline of the airport, affect the project plan?

- Modeling: